- #CA CHANGE RESIDENT MOVING EXPENSES TAX DEDUCTION FULL#

- #CA CHANGE RESIDENT MOVING EXPENSES TAX DEDUCTION CODE#

- #CA CHANGE RESIDENT MOVING EXPENSES TAX DEDUCTION FREE#

Information Youll Need Types and amounts of moving expenses. It's still available to some members of the Armed Forces as a Schedule 1 above-the-line adjustment to income, however.

#CA CHANGE RESIDENT MOVING EXPENSES TAX DEDUCTION CODE#

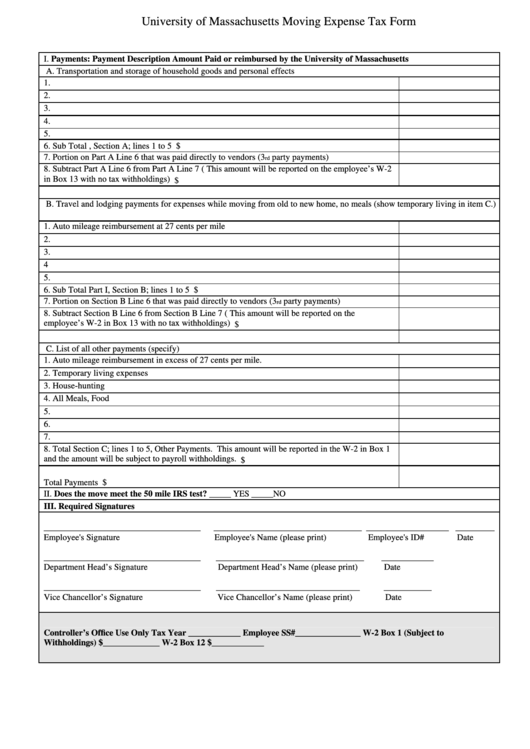

I did one more last trip to pick the last boxes, & clean & surrender the keys for storage, same as above. There are various deductions that are available for an individual who is preparing a tax return. ITA Home This interview will help you determine if you can deduct your moving expenses. Moving expenses were tax-deductible if you relocated to start a new job or to seek work until the Tax Cuts and Jobs Act (TCJA) eliminated this provision from the tax code for most taxpayers in 2018. Can I deduct these driven miles at same rate as Q2 on Line 01, as (Transportation and storage of household goods and personal effects) or do I have to use fuel receipts only?

#CA CHANGE RESIDENT MOVING EXPENSES TAX DEDUCTION FULL#

This can include things such as hiring an interstate moving company, buying packing materials, paying for. When you move more than 40 kilometres away to attend school full time, launch a new business, or take a new job, your moving expenses could be tax-deductible.

Are these above miles deductible as Line 02? (Travel (including lodging) from your old home to your new home)Īfter 4 days, on weekend morning, drove back to old city, & brought majority of things, car was full, still had to leave some back. Moving expenses are the costs associated with relocating to your new residence. Is any of these hotel nights deductible on Line 02? Hotel & Rental & New work are in same city. Rental was not ready, extended hotel for one more (third) night. I drove to new with my super essential things (toiletries, some work clothes, some food etc), 181 miles, got hotel for two night, reported to work at morning & later signed the rental agreement next day.

#CA CHANGE RESIDENT MOVING EXPENSES TAX DEDUCTION FREE#

Storage at old city was free for first month.

citizen or resident alien to deduct your expenses. If the new workplace is outside the United States or its possessions, you must be a U.S. The distance one way is 181 miles, using own vehicle. Certain personal tax credits such as the basic personal amount and spousal amount will be pro-rated based on the number of days that you were a resident of. Use Form 3903 to figure your moving expense deduction for a move related to the start of work at a new principal place of work (workplace). I meet the distance & time test for California Moving Expenses Deduction.

0 kommentar(er)

0 kommentar(er)